people's pension tax relief at source

Get all of the latest Business news from The Scotsman. The data collected including the number visitors the source where they have come from and the pages visited in an anonymous form.

What Are Itemized Deductions And Who Claims Them Tax Policy Center

From April 2020 the size of the annual allowance is gradually reduced from GBP 40000 to GBP 4000.

. Pensions in the United Kingdom whereby United Kingdom tax payers have some of their wages deducted to save for retirement can be categorised into three major divisions - state occupational and personal pensions. Salary sacrifice pension tax relief. B.

The Peoples Pension Trustee Board appoints new Trustee 31st May 2022. The American Rescue Plan Act of 2021 also called the COVID-19 Stimulus Package or American Rescue Plan PubL. Ontario Childcare Access and Relief from Expenses CARE Tax.

The deduction is capped at JPY 21 million. The 57bn BT Pension Fund. A group of 12 UK pension funds convened by the Church of England CofE Pensions Board have teamed up in a bid to find ways in which to support the climate transition in emerging markets.

For more information refer to https. If your staff pay income tax they will get tax relief whichever scheme you choose. Request to Reduce Old Age Security Recovery Tax at Source.

It meant you could claim once and get it automatically for ALL of the tax year at the 6week relief rate. For taxpayers with gross employment income over JPY 85 million with dependent children under age 23 or those taking the special disability exemption a rate of 10 will apply up to gross employment income of JPY 10 million. The schemes include the 83bn Universities Superannuation Scheme.

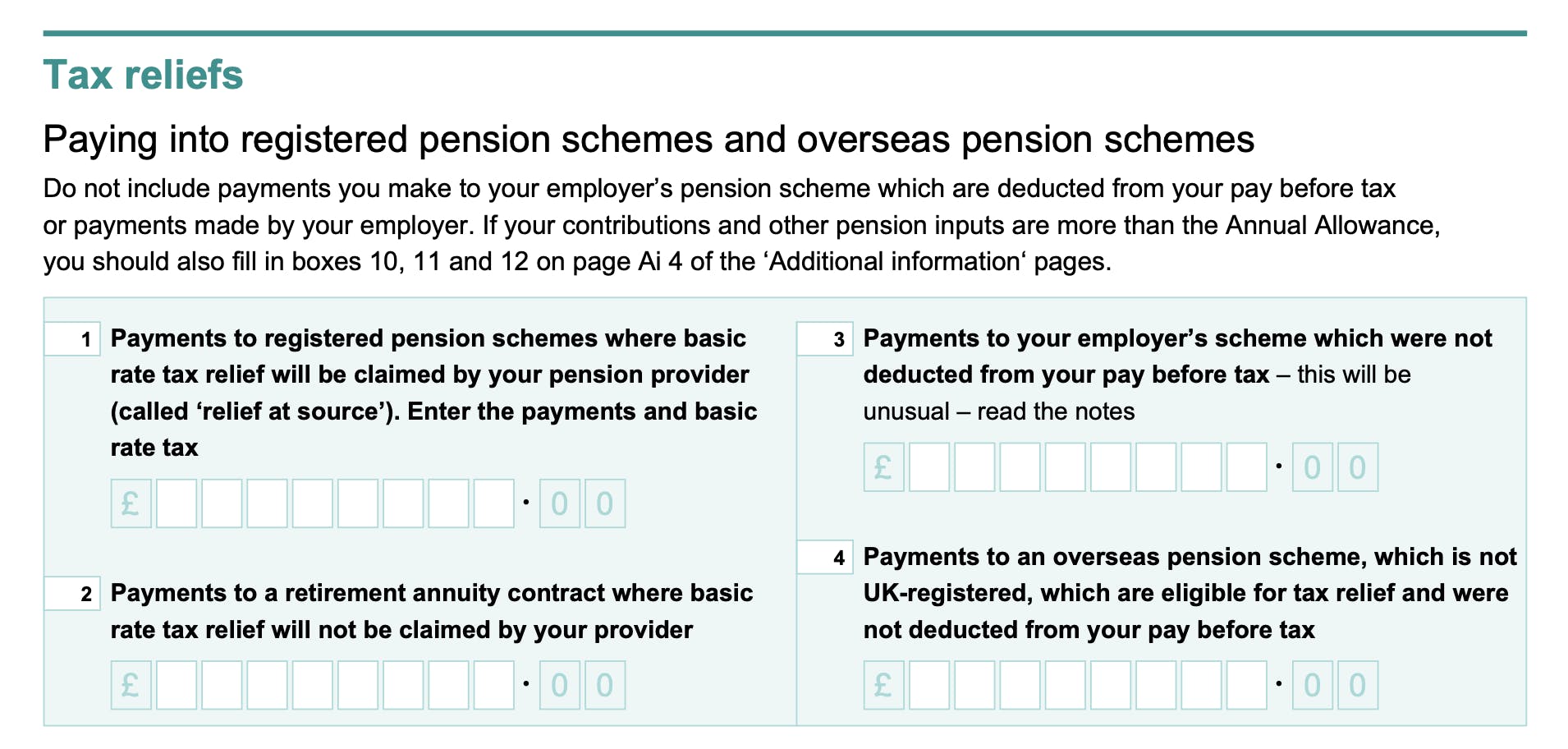

BCE bolsters strategic board with new hire 23rd May 2022. However if you have higher and additional rate taxpayers and your scheme uses relief at source they will need to claim their full tax relief by completing a tax self-assessment. Higher and additional rate taxpayers can claim further relief through their tax returns under the UK self-assessment regime.

Pacific Time on the delinquency date. You can find income tax rate information on GOVUK. It is linked to wage and price increases.

1172 text March 11 2021 is a US19 trillion economic stimulus bill passed by the 117th United States Congress and signed into law by President Joe Biden on March 11 2021 to speed up the countrys recovery from the economic and health effects of the. T3 Pooled Registered Pension Plan Tax Return. Recalling Article 151 of the Basic Law of the Hong Kong Special Administrative Region of the Peoples Republic of China.

Pursuant to California Revenue and Taxation Code Section 2922 Annual Unsecured Personal Property Taxes are due upon receipt of the Unsecured Property Tax Bill and become delinquent after 500 pm. If the delinquency date falls on a. Tax relief at the basic rate is given at source.

Providing fresh perspective online for news across the UK. Effectively restricting their tax relief on pension contributions. Joint Election for a Trust to be a Qualified Disability Trust.

When we first spotted this I couldnt quite believe it so I pushed HMRC hard to check it was true. Under Israeli domestic tax law WHT on payments of Israeli-source income is generally deducted at the corporate tax rate from all income remittances abroad unless a tax certificate is obtained from the ITA authorising withholding-exempt remittances or a reduced rate of tax pursuant to an applicable tax treaty. Pacific Time on August 31You can make online payments 24 hours a day 7 days a week until 1159 pm.

Ontario Focused Flow-Through Share Resource Expenses Individuals. In October 2020 the Government created a new temporary working-from-home microservice to help claim the tax relief for the 202021 tax year. The state pension is based on years worked with a 35-year work history yielding a pension of 17960 per week.

Desiring to conclude an Agreement for the avoidance of double taxation and the prevention of fiscal evasion with. The Peoples Pension is a flexible and portable workplace pension designed for people not profit. The Government of Canada AND The Government of the Hong Kong Special Administrative Region of the Peoples Republic of China.

What Is Pension Tax Relief Nerdwallet Uk

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

Tax Breaks For The Disabled And Their Caretakers Mint

Mandatory Disclosures Initial Supplemental Permanent Financial Relief Financial Documents Certificate Of Deposit Life Insurance Policy

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Accounting Small Business Bookkeeping Small Business Tax

New R D Tax Incentive For German Taxpayers Bdo Insights

Your Complete Guide To 2021 U S Small Business Tax Credits Freshbooks Blog

Nj Property Tax Relief Program Updates Access Wealth

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

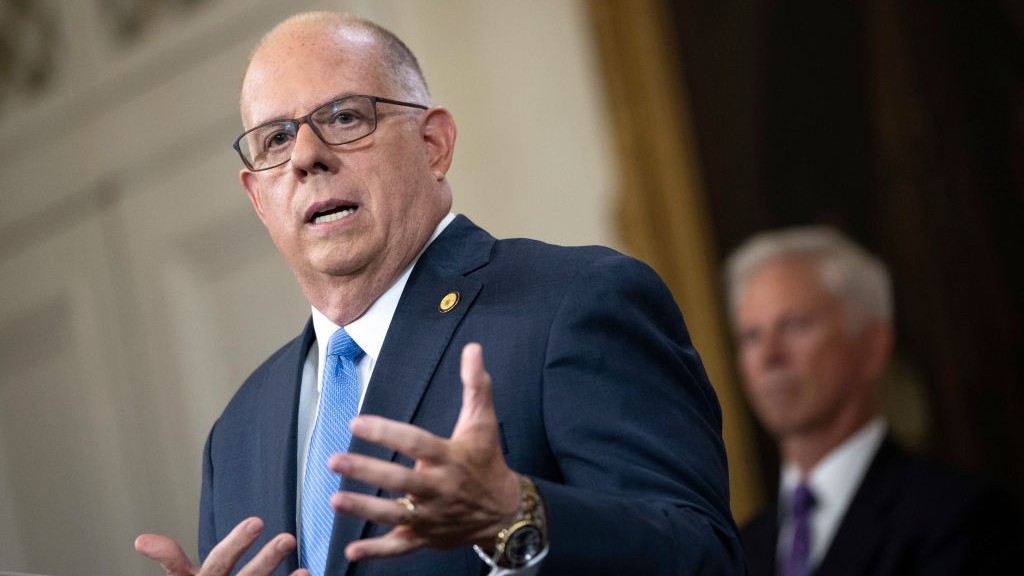

Governor Hogan Enacts Largest Tax Cut Package In State History Retirement Tax Elimination Act Becomes Law The Southern Maryland Chronicle

Are Medical Expenses Tax Deductible

Governor Hogan S Tax Relief Package State Local Fiscal Effects Conduit Street

Maryland Announces Tax Relief For Many Retirees Families Businesses Nbc4 Washington

How To Add Pension Contributions To Your Self Assessment Tax Return

How Pension Tax Relief Works And How To Claim It Wealthify Com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/Q47N7QYIJBNP5LWXH7HJLLX6XA.jpg)

German Finance Minister Pledges Tax Relief From 2023 Bild Reuters

Income Tax Ppt Revised Income Income Tax Tax

Maryland Announces Tax Relief For Many Retirees Families Businesses Nbc4 Washington